Rachel Reevesis experiencing a 'credibility crisis' tonight following her sudden reversal on hiking income tax in the Budget.

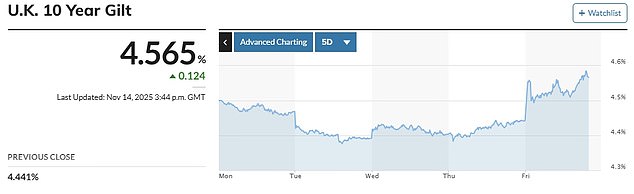

Markets have been adding a risk premium toUK governmentloan after the Chancellor's remarkable reversal - which occurred despite weeks of strong signals and aggressive rhetoric.

There are increasing concerns that another effort to "target" companies and extract more funds from the "rich" might erode trust and lead to more severe problems.

The reversal came after an open Labour rebellion against breaking the election promise, with Number 10 beginning to feel anxious aboutKeir Starmer's own survival.

Government officials stated that the adjustment was due to projections from the OBR watchdog being somewhat less negative than expected, with increased wage income partially balancing a poor productivity review, resulting in a £20 billion decline.

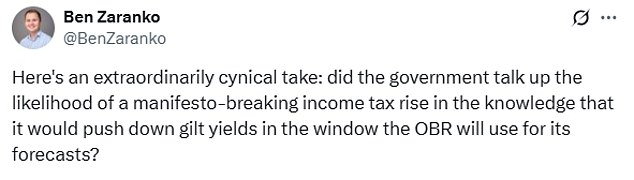

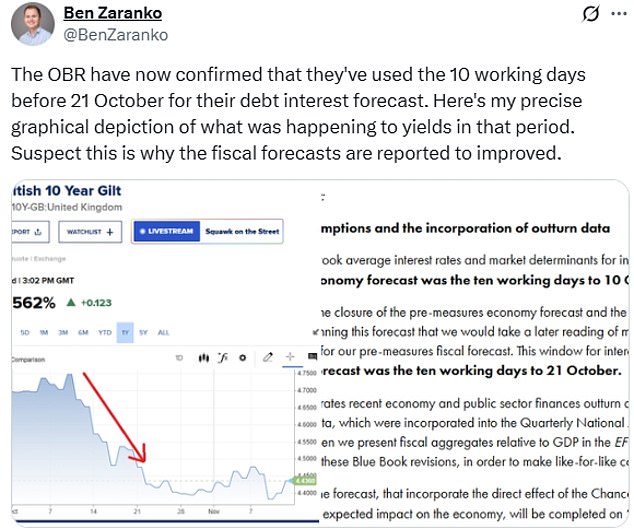

The IFS policy institute proposed that Ms Reeves may have 'exaggerated' the income tax rise last week in order to lower gilts yields for a short period, creating a more favorable environment for her Budget.

Nevertheless, Ms Reeves still appears to need to bridge a financial shortfall of as much as £40 billion by November 26, as she has pledged to restore 'buffer' that has been eliminated by discarding policies like benefit reductions.

Economists are concerned that she will now consider a 'Smorgasbord' of smaller tax hikes to help herself out of difficulty. These are likely to involve a new gambling tax and increased taxes on high-value properties, along with charges based on miles driven for electric vehicles.

Prolonging the unpopular 'stealth raid' freeze on tax thresholds for an additional two years may generate billions of pounds by pushing millions further into the system.

The Financial Times reported that Ms Reeves might further reduce tax thresholds in real terms, marking a significant intensification.

Treasury officials did not explicitly reject the possibility that the idea was under consideration, admitting that she will still need to employ 'major tools' to generate funds, with 'final choices yet to be made'.

LabourInside sources are feeling hopeless regarding the disorganized presentation before the important package, with responsibility being attributed to Treasury minister Torsten Bell and No 10 chief of staff Morgan McSweeney.

Yields on gilts — the primary method through which the government raises funds — rose sharply during early trading.

They retreated a bit following a Treasury announcement emphasizing the Chancellor's commitment to strengthen public finances, then moved higher again as the day ended.

Experts cautioned that the UK might experience a 'credibility crisis' following the turmoil of internal conflicts and public inconsistencies. Even the favored think-tank of Labour described the circumstances as 'unusual'.

The change in Ms Reeves' strategy seems to have occurred alongside a period of anxiety.Downing Streetin the face of the threat to Sir Keir

Just last week, the Chancellor gave an exceptionally rare pre-Budget address, cautioning that 'everyone' must 'contribute' to stabilizing the government's finances. She later made it clear that reducing capital expenditure would be the sole method to fulfill the commitments outlined in the manifesto.

That was widely regarded as evidence of extensive tax hikes.

Nigel Green, the chief executive of the international financial consulting firm deVere Group, cautioned that 'conflicting messages' were causing concern in the markets.

"This is precisely how trust-breaking incidents start," he stated.

Gold prices are falling, loan expenses are increasing, and the pound is losing value as markets worry the government is acting on the spot. There's nothing that investors dislike more than hesitation presented as a plan.

He stated, "The response is clear. Bond traders are informing the Treasury that they won't accept conflicting messages. They witnessed what occurred during the Truss crisis and won't patiently await explanations. They are incorporating risk into their pricing as it happens."

The Resolution Foundation, a policy institute frequently supported by Labour officials, cautioned that the report could harm the nation.

Chief executive Ruth Curtice stated: 'It is common for economic predictions and strategies to evolve as the election approaches'Budget.

It is unusual for such a significant amount to be openly exposed in public. The market's movements this morning and over the past few weeks indicate that a thorough examination of the handling of sensitive forecast information is necessary.

Economist and crossbench peer Lord Jim O'Neill said to BBC Radio 4's World at One: 'I'm somewhat surprised and puzzled... It is quite difficult to avoid the conclusion that the shift in attitude is happening due to the disagreements within the Labour Party.

Which one can somewhat understand, but if you're attempting to govern a country with the complex challenges we face, I believe you must be very cautious not to send signals to financial markets that you will prioritize party unity over fiscal responsibility.

Lord O'Neill, who previously served as chairman of Goldman Sachs, stated that the markets appreciated the Chancellor's earlier 'wartime' speech, suggesting the manifesto would be adjusted to ensure financial stability.

"Markets are saying, 'what on earth are you actually trying to accomplish?'," he stated.

If they focus on making minor adjustments to issues that are politically simple for the party, yet could harm growth even more—like attempting to target businesses merely because it appeals to the left wing of the party—this approach will not be well-received and will only create more problems in the future.

A frustrated government employee shared with the Daily Mail about the chaotic Treasury procedure: 'It's ironic that this is the one where they brought in the concept of a Budget Board, chaired by Torsten, to make everything more structured and collaborative.'

Ben Zaranko, an economist from the IFS think-tank, stated: 'Here's a highly cynical perspective: did the government suggest the possibility of an income tax increase that would break their manifesto in order to lower gilt yields during the period the OBR will consider for its predictions?'

The Budget Responsibility Office was said to have been notified of Ms Reeves' shift in position on Wednesday - although officials from the Treasury indicated it occurred sooner.

That was the same day Sir Keir faced intense questioning during PMQs regarding a supposed pre-emptive move by No 10 against cabinet ministers who were planning to contest his leadership.

Mr. Streeting—the primary focus—openly called for the dismissal of the advisors handling briefings and criticized Downing Street for 'self-destruction.'

Sir Keir has rejected demands to dismiss his chief of staff, Morgan McSweeney, stating that the particular information targeting Mr. Streeting did not originate from officials at No 10. However, this incident highlighted the fragility of his standing after a significant drop in public support.

Only 16 months ago, he entered No 10 following one of the most significant electoral victories in recent political history.

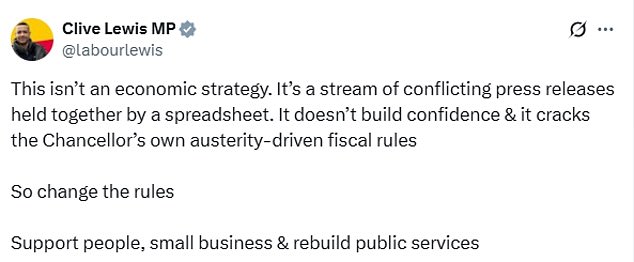

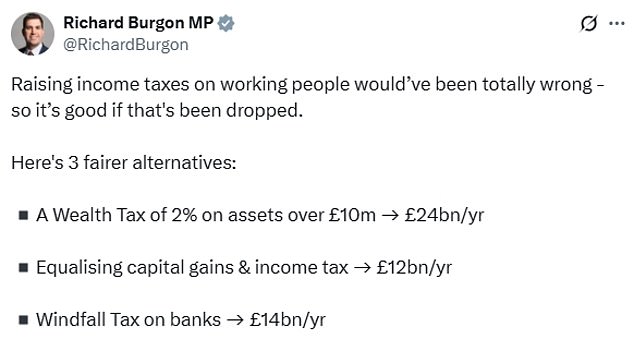

Members of the left-wing party have welcomed the cancellation of the increase in income tax and have made new demands for a 'wealth tax'.

Speaking on LBC Radio this morning, Mr Streeting also supported the reversal. "I am not in favor of violating campaign promises," he stated.

I believe that confidence in politics and political figures is currently low, and it is our duty not only to restore our economy and public services, but also to restore faith in the political system itself.

He stated: 'The fact that the Chancellor – and we're operating on assumptions here – but the fact that the Chancellor was said to be thinking about violating her party's promises indicates two things: First, the public finances are facing significant strain, and second, she is deeply and clearly dedicated to her financial guidelines, which means she has some difficult decisions to consider, and she is evaluating them.'

I didn't communicate with the Chancellor last night. I saw the reports this morning indicating she is no longer intending to raise income tax.

I believe the news overnight has demonstrated that people make assumptions about the Budget, but in reality, you can't know its contents until the day it is announced, and this applies to the Cabinet as well.

So, we'll all have to wait and find out.

Labour insiders claimed Mr Streeting appeared to have a revived confidence that he could secure the leadership position from Sir Keir.

A government official told the Daily Mail: 'If life gives you lemons... and he has been allowed to roam freely through the orchard this week.'

A former Labour minister stated that Sir Keir should dismiss Mr. McSweeney and begin to pay attention to his MPs.

"If you're in the Alps during spring and you fire a weapon, resulting in an avalanche—don't be surprised," they remarked, alluding to the briefing concerning Mr. Streeting.

And don't be surprised if everyone responds to it.

A senior Conservative MP quipped, "It Was Wes Wot Won It"

But Mr. Streeting attempted to minimize the conflicts, asserting:I believe the Prime Minister and I are both in the same situation of being very frustrated, as this is a complete distraction.

When asked whether he had confidence in Mr. McSweeney, the Health Secretary responded, "Of course I do."

The Minister of Health was also questioned regarding a 2018 video where he stated he believed he would be the prime minister in 2028.

Mr. Streeting stated, "As is frequently mentioned, it will be my sense of humor that eventually leads to my downfall. But if you don't believe in yourself, who will?"

On Tuesday, grim figures showed that unemployment reached its highest point in over four years, possibly prompting Ms Reeves to reconsider her stance. Additionally, further signs of an economic slowdown were observed yesterday, as GDP remained stagnant during the third quarter.

Ms. Reeves is anticipated to adopt what has been called a 'smorgasbord' strategy – making minor adjustments to the tax system in an effort to extract more funds from employees and those with higher incomes.

The Cabinet is reportedly so split on the course of action that Ms Reeves drafted two Budgets, one openly violating the manifesto and another merely touching upon its boundaries.

A representative from the Treasury stated: 'We refrain from commenting on rumors regarding tax adjustments that occur outside of official fiscal events.'

The Chancellor will present a Budget that makes equitable decisions to establish solid foundations for securing Britain's future.

Julian Jessop from the IEA research institute has calculated that substantial decreases in tax thresholds would be required to generate the same revenue as a 1p rise in the standard tax rate – £8 billion.

The upper tax bracket might need to decrease from £50,270 to approximately £46,000, while the highest rate could drop from £125,000 to £100,000. According to calculations from the Daily Mail, an individual earning £50,000 would end up paying roughly £750 more in taxes annually.

If the reduction in the personal allowance occurred at the same point where the top tax rate applies, someone earning £100,000 would face an additional £5,800 in taxes.

Conservative Party leader Kemi Badenoch stated that Ms. Reeves must drop any intentions to increase tax levels.

During a visit to a generator rental company in Writtle, Essex, Ms. Badenoch stated: "The issues we are facing today resulted from her previous budget."

The most recent costly budget is leading to the emergence of new issues that she aims to bring about.

What we're requesting of her is to take the lessons from the previous budget and completely halt the increase in taxes.

So, if they aren't planning to increase income tax, that's positive – I'm not sure if it's accurate or not, we'll have to wait and find out – but we must prevent them from taxing property, pensions, savings, and everything else.

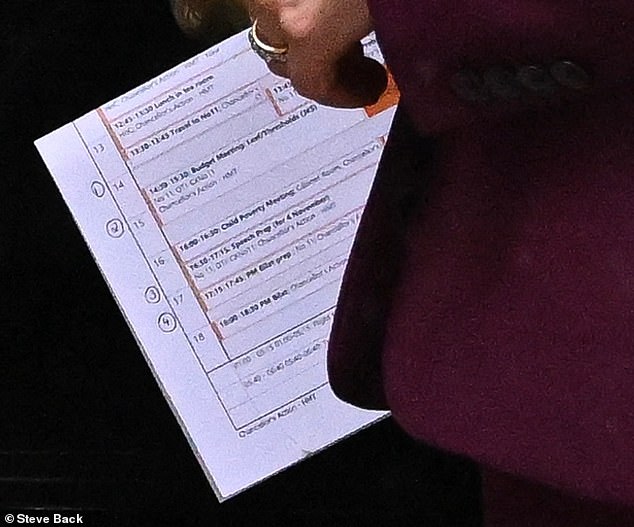

Earlier this month, Ms. Reeves was seen exiting Downing Street with part of her diary visible, featuring the word 'Thresholds' to characterize a particular meeting.

There was already a general anticipation that the Chancellor would continue the ongoing pause on individual tax thresholds, which were implemented by the Conservatives.

Economists have cautioned that the number of individuals subject to the 40p tax rate could exceed 10 million in such a scenario.

Approximately one in five taxpayers will be required to pay 40 per cent or higher taxes on their income if, as anticipated, the Chancellor expands the 'stealth tax', according to the Institute for Fiscal Studies.

Fiscal drag will result in a greater number of individuals working in middle-class roles, including senior nurses, police officers, and teachers, paying the higher tax rate.

For the first time since its launch, every pensioner will be required to pay tax on their entire state pension income during the 2027-28 period, according to the think-tank.

Additional low-wage employees will become liable for taxes as a result of stagnant thresholds and significant increases in the minimum wage, it noted. It also mentioned that an ongoing freeze would lead to more individuals qualifying for Universal Credit at a time when the cost of benefits is becoming increasingly unsustainable.

Prolonging the cap freeze, introduced by Rishi Sunak in 2021, for an additional two years until April 2030 could generate £8.3 billion for her in that year, as stated by the research institute.

In addition to the £42 billion the policy is already projected to generate by 2027-28, which was when it was scheduled to conclude.

A genuine decrease in thresholds would result in individuals who pay income tax or National Insurance experiencing higher taxes, and it would also lead to more taxpayers being pushed into higher tax categories.

Read more- Is Rachel Reeves' effort to address a massive £31 billion shortfall leading the Treasury to consider prolonging the tax threshold freeze?

- Will millions more British citizens encounter significantly increased tax rates if Rachel Reeves remains committed to her Budget pledges?

- How is Chancellor Rachel Reeves handling the shocking tax increase while concerns about unprecedented financial pressures grow?

- Could Rachel Reeves' upcoming Budget introduce one of the most significant tax increases in history, featuring staggering £40bn proposals?

- Is Britain set to experience extraordinary financial challenges as Rachel Reeves gets ready to implement one of the most significant tax increases ever seen in the upcoming Budget?